Learn how Secure Automated Financial Routing (SAFR) streamlines PCI-compliant payments in call centers. Discover how TOG’s AI-enabled solution reduces risk, enhances security, and improves payment completion rates for enterprise operations.

Businesses handling customer payments through contact centers face consistent challenges: rising compliance costs, increased fraud risk, and customer frustration caused by slow, agent-dependent payment workflows. As digital payments accelerate, companies need a way to securely capture financial information without exposing sensitive data to contact center agents or systems.

Secure Automated Financial Routing (SAFR) is transforming how payments are captured, verified, and processed across customer service environments. As a tech-enabled BPO, The Office Gurus integrates AI-driven automation, real-time analytics, and PCI-compliant payment routing to help brands protect cardholder data while improving speed, security, and operational efficiency.

What Is Secure Automated Financial Routing and Why Does It Matter?

Secure automated financial routing directs payment interactions through policy-driven, encrypted, and compliant channels, ensuring cardholder data never enters non-secure systems or agent workflows. Instead of verbally sharing information with a live agent, customers complete payments through self-service IVR, chatbots, SMS, or redirected secure flows.

This automated routing reduces risk by:

- Minimizing cardholder data exposure

- Preventing agents from viewing or handling sensitive information

- Streamlining transaction flows across multiple channels

- Supporting enterprise-grade compliance protocols

At TOG, this capability is powered by GuruPay (SAFR), our secure, PCI-compliant solution designed to simplify and safeguard payment processing across BPO operations.

SAFR: TOG’s PCI-Compliant Payment Automation Solution

SAFR (Secure Automated Financial Routing) is the technology used in TOG for managing compliant payments across voice and digital channels. Built to reduce PCI scope while improving customer experience, SAFR allows customers to complete transactions without agent involvement and with full end-to-end protection.

Core Capabilities

- PCI-DSS Level 1 compliant

- Voice and digital payment capture (IVR, chatbot, SMS)

- Tokenization and end-to-end encryption

- Integration with existing payment gateways

- Customizable payment flows (partial, full, recurring)

Where It’s Most Useful

- Utility or subscription bill payment

- Collections and account resolution

- Retail checkout support via IVR or SMS

- Post-call payment redirection for secure processing

By integrating these capabilities directly into TOG’s AI and automation ecosystem, SAFR delivers secure routing for payments across enterprise operations, ensuring consistency no matter the channel.

How to Handle PCI-Compliant Payments in a Contact-Center Environment

PCI DSS requirements mandate strict controls to protect cardholder data. In traditional call center workflows, agents often become the weakest link, not intentionally, but simply because the environment exposes them to sensitive information.

TOG’s SAFR solution simplifies PCI DSS compliance by:

- Redirecting payments away from agents and into secure flows

- Using tokenization so card data never touches TOG systems

- Encrypting transactions end-to-end

- Reducing the number of systems in PCI scope

This approach minimizes risk, lowers compliance costs, and enhances brand trust. By enforcing least-privilege access and reducing data retention, enterprises achieve a more sustainable compliance posture while maintaining service quality.

How Payment Routing Automation Increases Efficiency

Secure automated financial routing isn’t just about security, it’s also a high-value operational tool for enterprises and BPOs.

SAFR improves efficiency in several ways:

- Faster processing: Customers complete payments quickly without waiting for an agent

- Reduced handle times: Agents can focus on service, not manual transactions

- Higher first-attempt success rates: Automated flows reduce errors and rework

- Scalable 24/7 payment capabilities: Ideal for global or high-volume operations

By keeping payments out of non-secure environments, brands also simplify compliance workflows, reduce audit burden, and improve overall customer satisfaction.

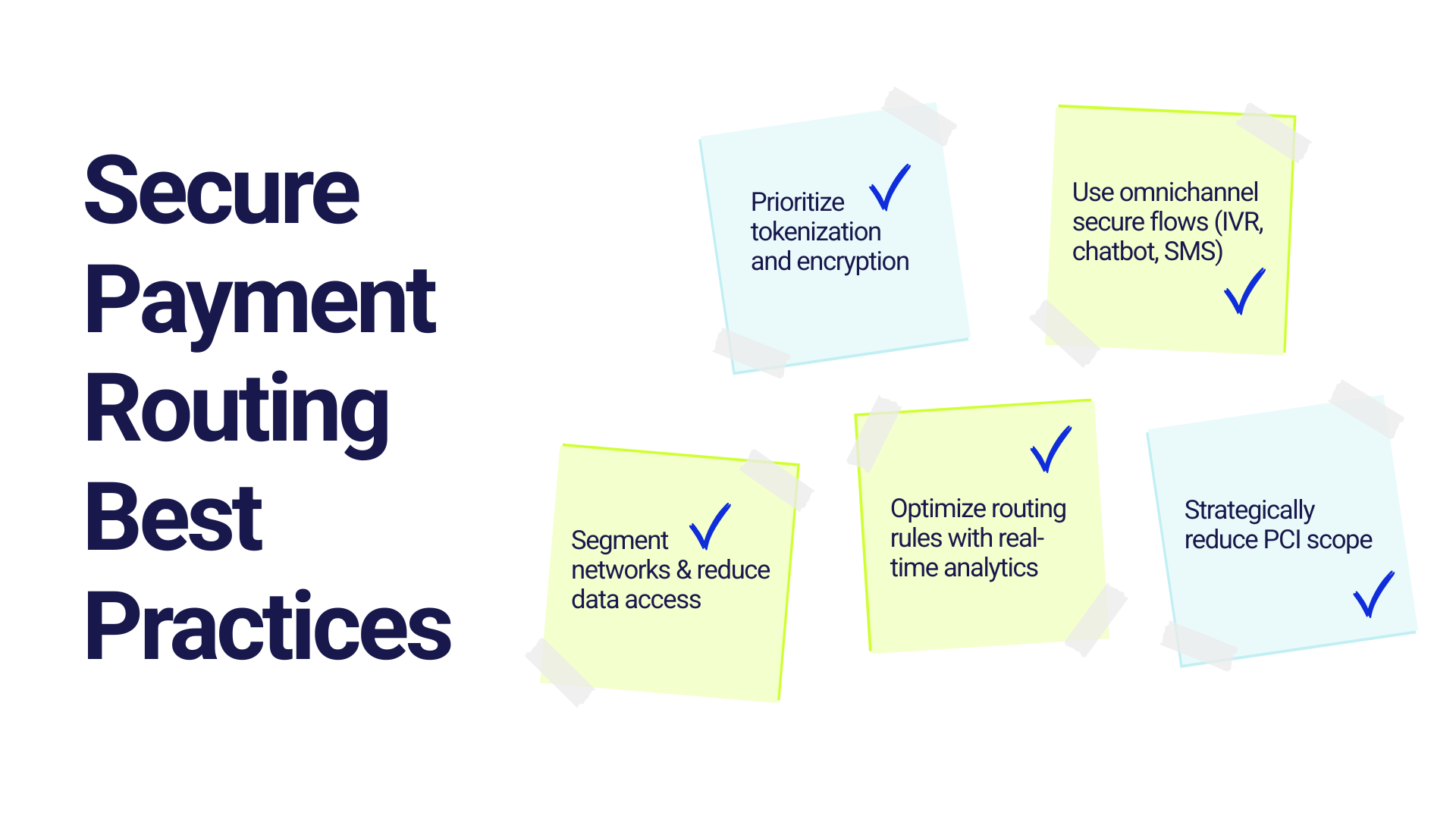

Best Practices for Secure Payment Routing in Customer-Service Operations

For companies adopting secure automated financial routing, several best practices ensure long-term success:

1. Prioritize encryption and tokenization

These are foundational for maintaining PCI compliance and preventing data exposure.

2. Use omnichannel secure routing

Support consistent payment flows across IVR, chatbots, and SMS.

3. Segment networks and minimize access

Keep payment systems fully isolated from non-payment environments.

4. Optimize routing rules continuously

Real-time analytics improve completion rates and reduce friction.

5. Reduce PCI scope strategically

Lean, automated flows greatly reduce compliance cost and complexity.

TOG’s SAFR platform enables all these best practices while supporting enterprise scalability and operational stability.

Operational & Business Impact of SAFR

Companies using SAFR experience measurable improvements, including:

- Reduction in agent involvement and payment-related workload

- Lower risk of data exposure and fraud

- Higher successful payment rates

- Improved call-to-payment conversion

- Faster customer resolution and stronger satisfaction

These outcomes align directly with TOG’s value strands: streamlined operations, cost-savings, connected experiences, and strong security & compliance.

TOG’s Human + Technology Approach

While some believe automation replaces human agents, TOG’s philosophy is different:

technology empowers human connections.

By embedding AI, automation, and real-time insights, including SAFR, into each interaction, our Gurus respond faster, more accurately, and more empathetically. This blended approach enhances both operational performance and customer experience while ensuring every transaction remains secure.

FAQ: Secure Automated Financial Routing (SAFR)

1. What is Secure Automated Financial Routing (SAFR)?

SAFR is TOG’s PCI-compliant payment automation solution that routes customer payments through secure digital or IVR channels without exposing sensitive data to agents. It uses tokenization, encryption, and policy-based workflows to protect cardholder information and streamline payment processing.

2. How does SAFR help reduce PCI DSS compliance scope?

SAFR keeps cardholder data out of the contact-center environment by capturing payments through secure, isolated channels. Since agents and internal systems never access sensitive information, organizations reduce the number of systems in PCI scope, lowering audit requirements, compliance risk, and operational cost.

3. Why should companies automate payment routing in their contact center?

Automated payment routing improves security, reduces fraud risk, shortens handle times, and increases payment completion rates. With 24/7 payment capabilities and standardized secure flows, enterprises can offer customers a faster, more trusted payment experience while minimizing agent workload and exposure to sensitive data.

Ready to Strengthen and Secure Your Payment Experience?

TOG’s SAFR solution enables enterprises to reduce risk, accelerate payments, and simplify PCI compliance while delivering a smoother customer experience.

If you’re ready to modernize your payment workflows with secure automated financial routing, The Office Gurus is here to help. Contact us today for more information about our solutions.